What Is Business Interruption Insurance and Do You Need It?

3/19/2022 (Permalink)

As a business owner, you are forced to weigh the pros and cons of every possible expense before you make an investment. One expense you may question is interruption insurance. Do you need it, or will it end up costing you more than you will save?

The Basics of Business Interruption Coverage

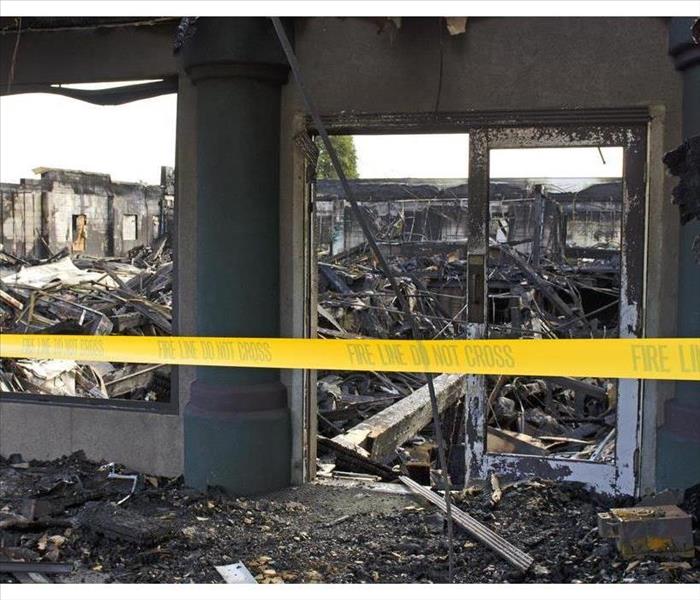

You already have commercial property coverage, so why would you need interruption coverage? Good question. Commercial property coverage insures against damage to your building and its contents due to a covered loss, such as a fire. Depending on your policy, this type of coverage may cover increased expenses that result from fire damage as well as the loss of income. However, what happens if your business is forced to close for an extended period of time while fire restoration is underway, or if your business suffers additional losses after you reopen? That's where interruption insurance comes in. This type of coverage covers the following:

- Loss caused by the slowdown or suspension of your business operations

- Losses accrued during the restoration period

- Losses sustained after resuming operations and that are a result of the fire damage

Business interruption coverage also covers payroll costs during the restoration period. This ensures you can retain your employees while your business is closed. It also covers the cost of taxes, business loan repayments and relocation expenses.

What Interruption Coverage Does Not Cover

Though interruption coverage can be extremely helpful in the event of a loss, it does not cover everything. For instance, it does not cover the cost of utilities that continue to run despite the fact that your business is closed. To ensure you don't get charged with electricity, water, gas or any other utilities while your doors are closed, call your utility companies to have them shut them off.

This type of coverage also does not cover direct property damage. That is what commercial property coverage is for. If the damage is the result of an earthquake or flood, your earthquake or flood policy should cover the cost of damages.

To learn more about what interruption insurance does and does not cover, contact your Mahtomedi, MN, fire restoration team. In addition to providing you with more information, it can help you find appropriate coverage.

24/7 Emergency Service

24/7 Emergency Service